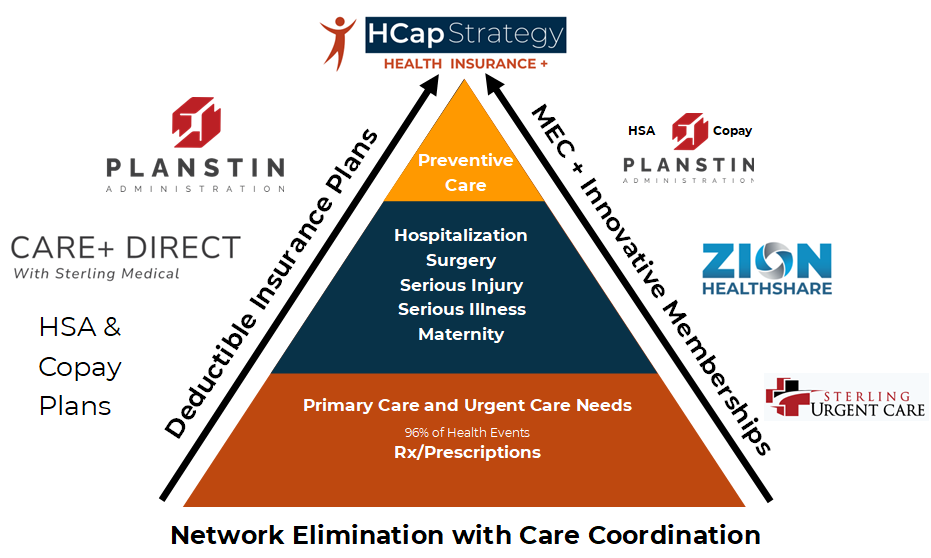

Traditional and Innovative Health Insurance Plans

Similar to other all insurance offerings that tend to have a higher premium, a fairly high deductible, potential for either an HSA and no need to ever present yourself as a self-pay patient. Rx Coverage. All preventive is 100% covered. No network restrictions.

A great option for those that just want traditional health insurance.

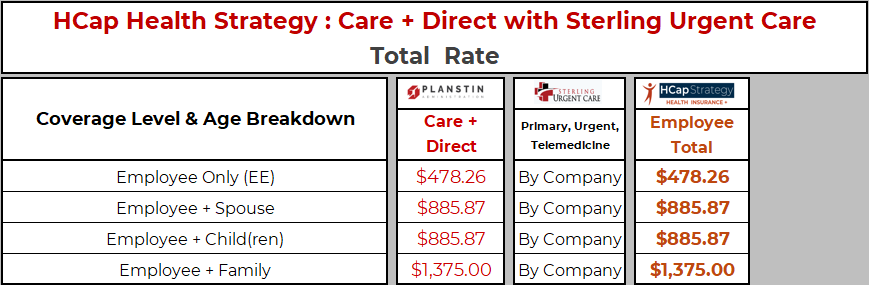

By combining Sterling Urgent Care Clinics and Planstin’s Care you receive your care at $0 cost with your deductible waived. Procedures that can be accomplished at Sterling Medical Clinic will are at $0 cost to you. Care outside of Sterling Medical Clinics can also be accomplished at $0 cost to you through using Planstin’s Care Coordination Team. Emergency Room and Emergency Transport will be applied to your deductible and max out of pocket of this plan. Affordable, comprehensive insurance coverage is here!

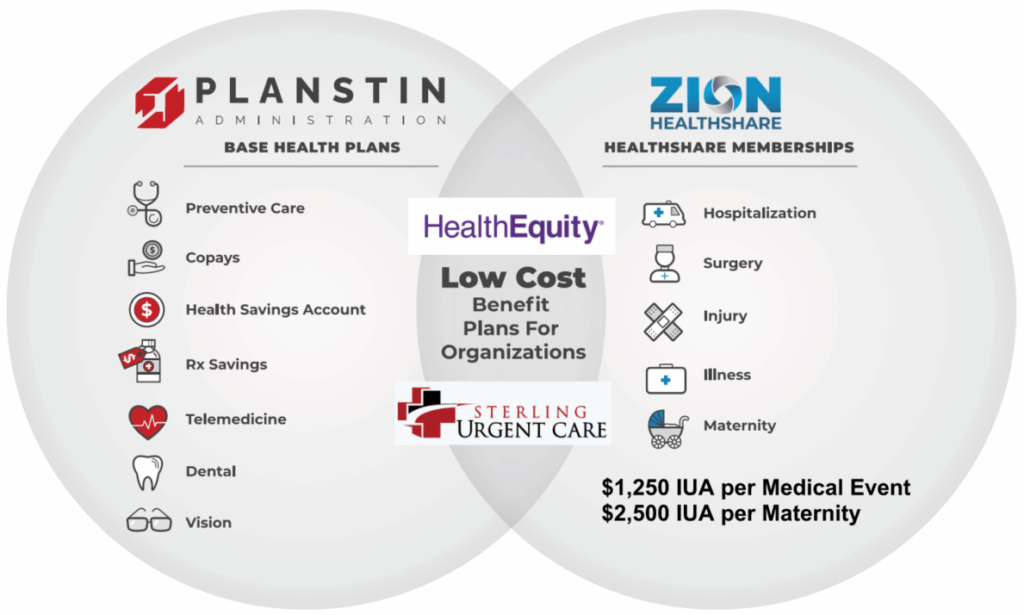

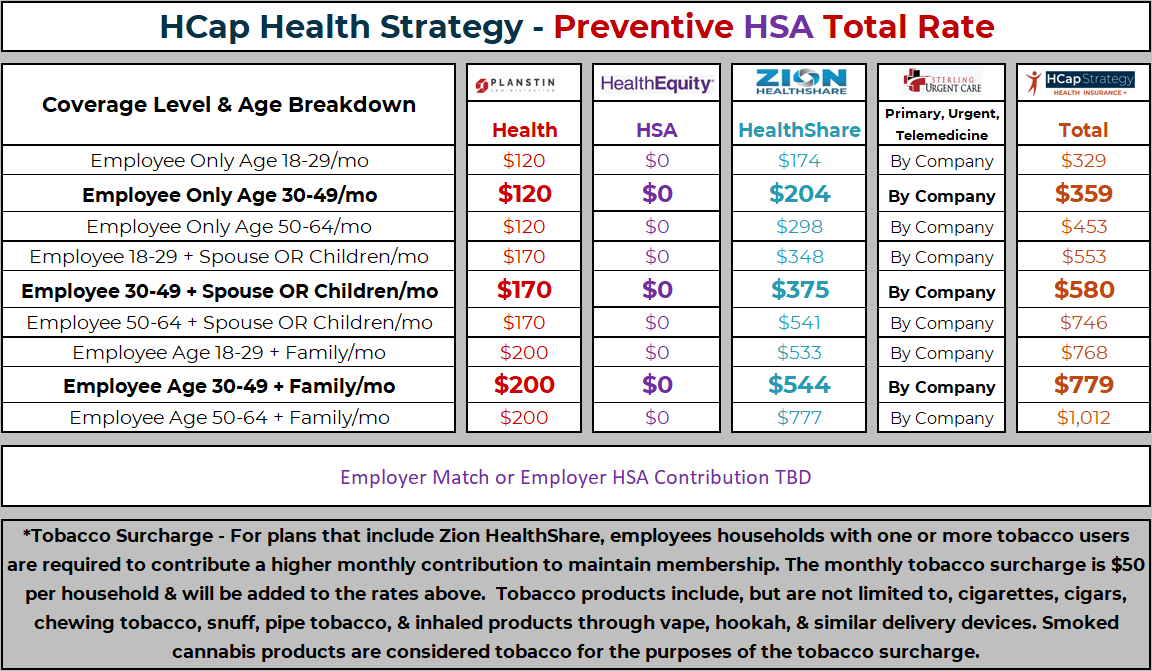

Planstin Preventive MEC Plan Pairing with Zion HealthShare means no deductible to meet, rather for any qualifying expense (see Zion HealthShare member guidelines), you pay the first $1,250 (known as your Initial Unshareable Amount or IUA) of qualifying medical events and the HealthShare pays the rest. After you pay 3 IUAs, in a 12 month period, any other major event over $500 is paid by Zion HealthShare w/o requiring another $1,250 IUA. More money can go into your Health Savings Account if the HSA Plan is selected or choose the Copay plan if you prefer a copay instead of receiving HSA dollars. All Preventive care 100% covered. Rx Discounts.

See Member Guidelines and talk to an HCap Insurance Agent to learn how Pre-Membership Conditions are handled on this plan.

With these plans you present yourself as a “Self-Pay” Patient for anything that is not preventive coverage and pay at time of service or when billed. Your responsibility is for first $1,250 IUA using your HSA (if applicable). You have responsibility to learn the Zion HealthShare Member Guidelines. Your employer will also contribute to your Health Savings Account Plan.

Note: High blood pressure, high cholesterol, and diabetes (types 1 & 2) are not considered pre-membership medical conditions as long as 1. no hospitalization for the condition in 12 months prior to joining and 2. the member is able to control the condition through medication or diet.

Planstin Contact Info

Member Services 888-920-7526 or

member@planstin.com

Claims Fax 435-631-9478 or

claims@planstin.com

The mission of Doable Wellness is to increase motivation to live a healthier life by providing incentives and tools that make healthy behaviors doable.

See all of the great tools available to you as part of your HCap Health Strategy by clicking below:

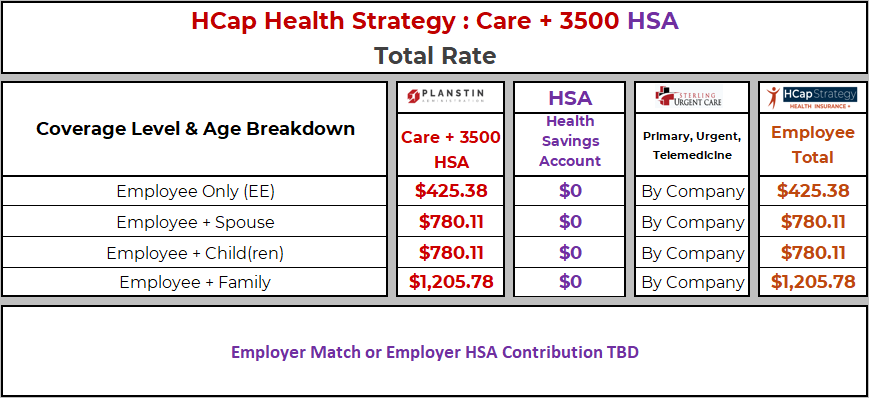

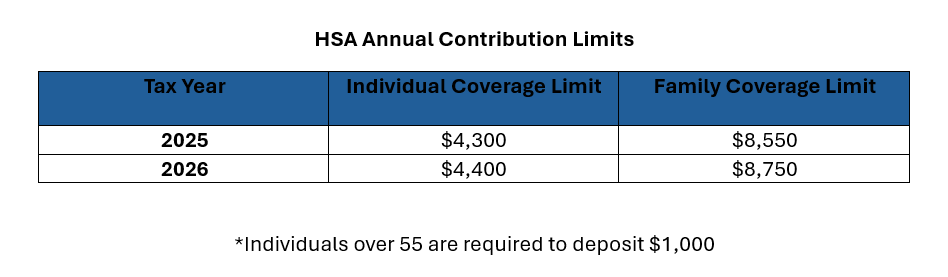

Your plan may include a Health Savings Account. Contributions can be made to this account per the chart below. Some contributions may be included in your health plan. Some contributions may be included due to your healthy behaviors through Doable Wellness. You can take full advantage of your HSA by adding additional contributions per the limits below. All HSA Contributions are tax free and can be used for any qualified medical expenses (click below).

Health Equity Bank Contact Info

Member Services 1 (866) 346-5800 or www.healthequity.com

Contact Info

© Copyrighted 2025 HCap Strategy

862 Soth Main, STE 2

Brigham City, UT 84302