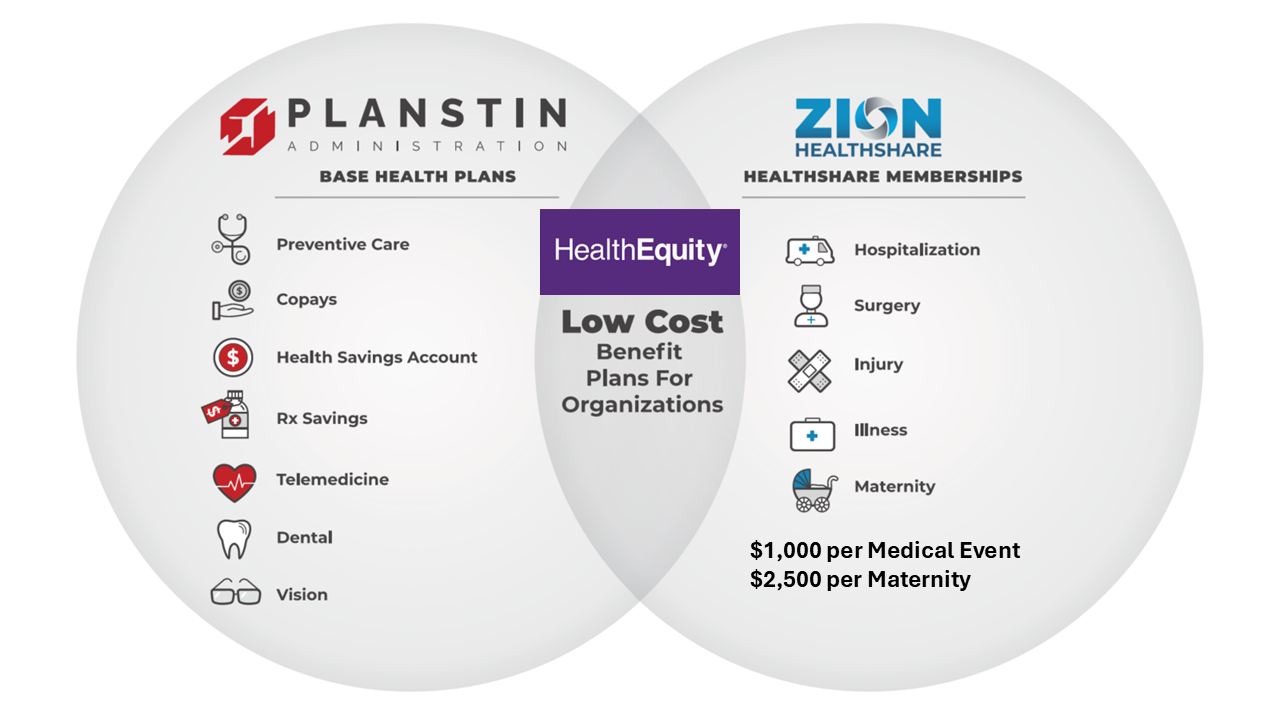

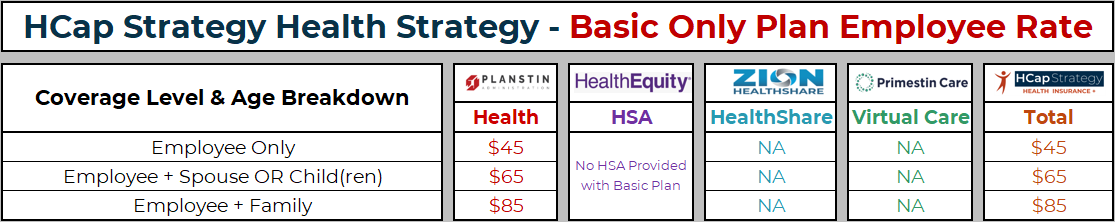

Below are options that can be combined, per your choice, to make up a comprehensive health strategy. You can select which options are the best fit for you and your household.

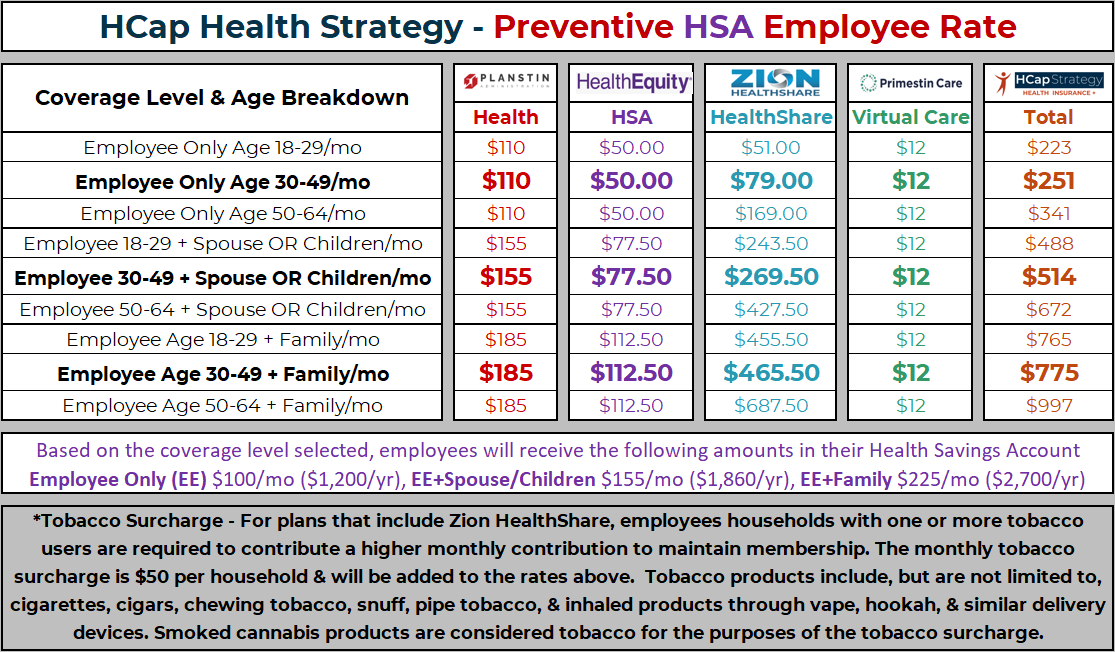

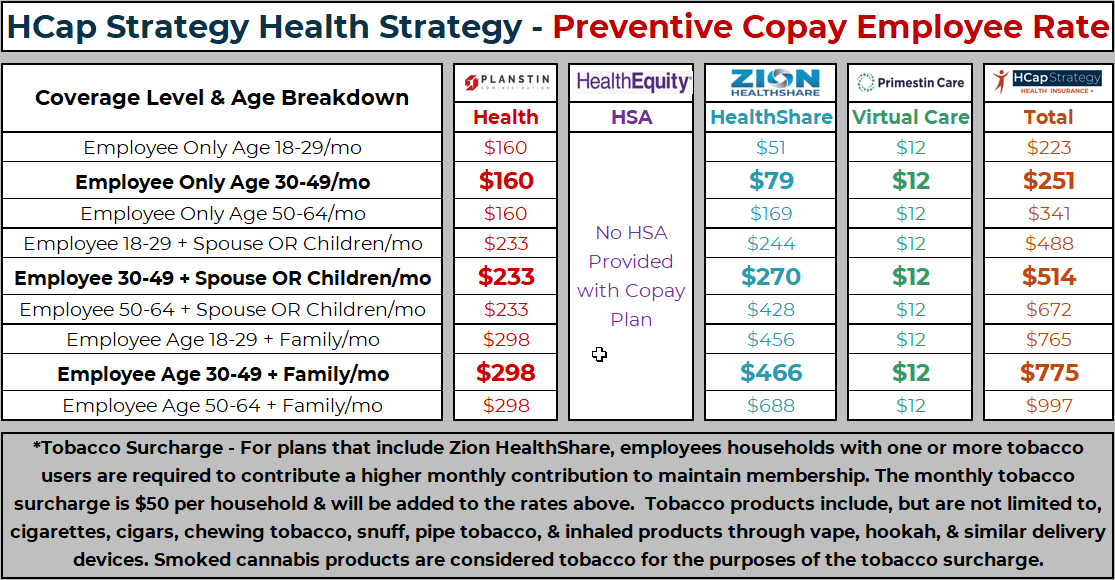

The HSA amounts listed above are just RECOMMENDED amounts. You can choose to contribute any amount to your Health Savings Account.

Pairing with Zion HealthShare means no deductible to meet, rather for any qualifying expense (see Zion HealthShare member guidelines), you pay the first $1K (known as your Initial Unshareable Amount or IUA) of qualifying medical events and the HealthShare pays the rest. After you pay 3 IUAs, in a 12 month period, any other major event over $500 is paid by Zion HealthShare w/o requiring another $1K IUA. More money can go to HSA in HSA Plan or a Copay plan can be chosen. All Preventive is care 100% covered. Telemedicine is free. Rx Discount..

If an illness or injury exists that a person with Zion HealthShare coverage has been examined, diagnosed, taken medication, had symptoms or received medical treatment in the last 24 months , these medical needs will qualify for sharing by Zion HealthShare per the Pre-Membership Medical Condition Phase-In Period. Expenses related to mental health are not shareable with Zion HealthShare, but Primestin Tele-Health can be added as a strong compliment for improving mental health and prescriptions are covered through Planstin.

Learning Curve: With these plans you present yourself as a “Self-Pay” Patient for anything that is not preventive coverage and pay for the coverage or the first $1K IUA using your HSA (if applicable). You have responsibility to learn the Zion HealthShare Member Guidelines. These innovative plans have Health Savings Account dollars built into the premium that you will receive in your HSA and can use for any qualifying medical expense! Note: High blood pressure, high cholesterol, and diabetes (types 1 & 2) are not considered pre-membership medical conditions as long as 1. no hospitalization for the condition in 12 months prior to joining and 2. the member is able to control the condition through medication or diet.

Your Planstin Plan can be used for:

Preventive Care

Copays (except HSA Plan)

HSA Acct (If HSA Plan selected)

Rx Coverage & Savings

Remember any medical conditions over $1,000 that are not classified as pre-membership needs will be covered by Zion HealthShare if selecting a plan that includes Zion HealthShare.

Planstin Contact Info

Member Services 888-920-7526 or

member@planstin.com

Claims Fax 435-631-9478 or

claims@planstin.com

1. If an emergency, get emergency care. Inform hospital you are a “self pay” customer. You can submit your need after you receive needed care.

2. If your need is over $1,000 and is a scheduled procedure, a surgery, or maternity, submit your need before the event by clicking “Medical Need Request” below.

3. Needs are required to be submitted within 6 months of the date care was received.

You can use any network, hospital, or doctor with Zion

Healthshare for your need over

$1,000 as long as your need is

not a pre-membership medical

condition

Hospitalization

Surgery

Critical Illness

Maternity

Quick questions to determine pre-membership needs

1. Is your current medical need request related to an illness that presented symptoms prior to membership?

2. Did your injury happen prior to membership?

3. Are you currently on any medication related to this condition?

4. Did you see your doctor or have testing done prior to membership for this condition?

Year Three: $50,000 max per need

needs@zionhealth.org

Disclaimer: Zion HealthShare is not health insurance, nor is it a discount healthcare program, and it is not regulated by state insurance codes. Your membership with Zion Healthshare is voluntary, as is any financial assistance provided by the community. Though the community aims to help all members with eligible needs, you are ultimately responsible for paying your medical bills.

Open Market Plans are traditional insurance plans that are similar to other group insurance offerings. The plan you choose will determine your monthly premium, deductible, max out of pocket and other plan benefits. Copay or HSA plans are available.

These plans are especially excellent when pre-existing conditions are a consideration regardless of income. However, depending on the household income, a government subsidy may be available. You will pay for the monthly premium for these plans using your own personal credit or debit card rather than through payroll.

If you are the employee that needs health insurance coverage, because your employer offers what is deemed as affordable health insurance, you won’t be eligible for a health insurance subsidy on the open market, however your spouse and/or family may be eligible for a subsidy.

Your HCap and Encore representative can help you navigate to the plan that is the best fit for your circumstances.

The mission of Doable Wellness is to increase motivation to live a healthier life by providing incentives and tools that make healthy behaviors doable.

See all of the great tools available to you as part of your HCap Health Strategy by clicking below:

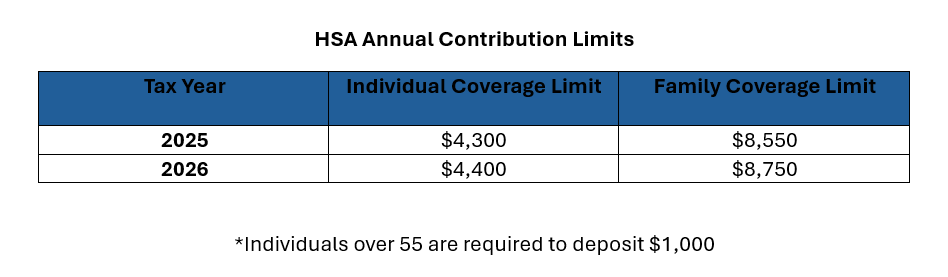

Your plan may include a Health Savings Account. Contributions can be made to this account per the chart below. Some contributions may be included in your health plan. Some contributions may be included due to your healthy behaviors through Doable Wellness. You can take full advantage of your HSA by adding additional contributions per the limits below. All HSA Contributions are tax free and can be used for any qualified medical expenses (click below).

Health Equity Bank Contact Info

Member Services 1 (866) 346-5800 or www.healthequity.com

Contact Info

© Copyrighted 2025 HCap Strategy

862 South Main, STE 2

Brigham City, UT 84302